Annuity and sinking funds

Annuity And Sinking Funds. Solved by verified expert:your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. The annuity formula and sinking fund formula will make the facts more clear. As annually, amount is invested in outside securities; In section 9.2 (simple interest and discount) and section 9.3 (compound interest ), we did problems where an amount of money was deposited lump sum in an account and was left there for the entire time period.

5.2 Annuities and Sinking Funds Example 6 YouTube From youtube.com

5.2 Annuities and Sinking Funds Example 6 YouTube From youtube.com

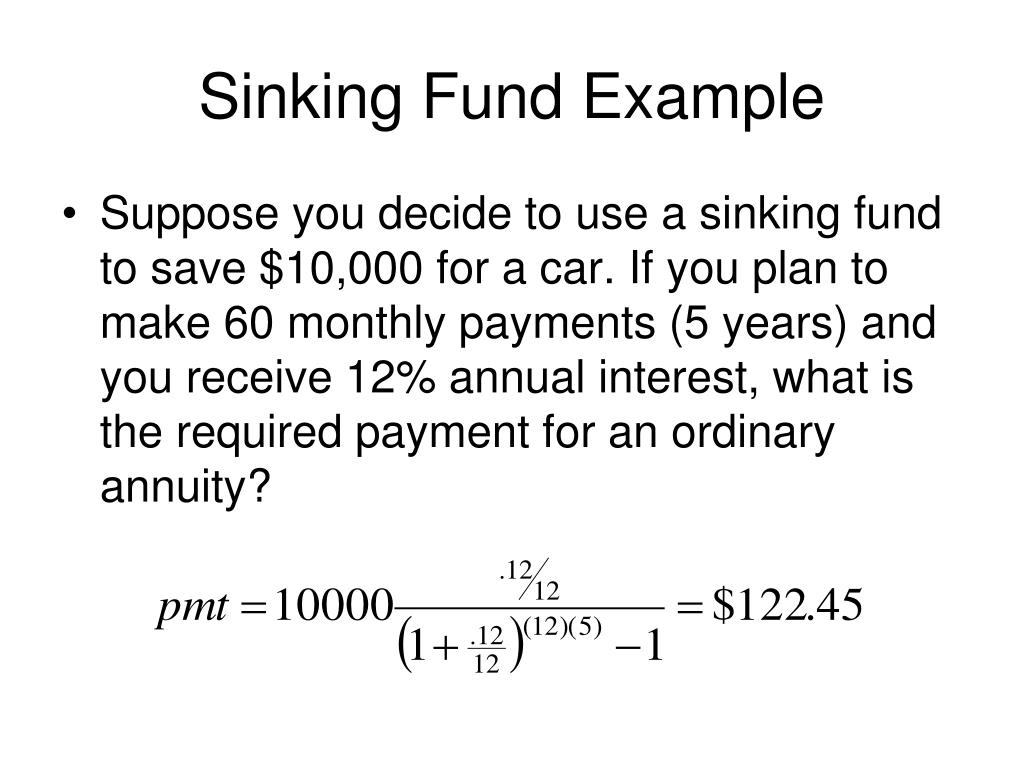

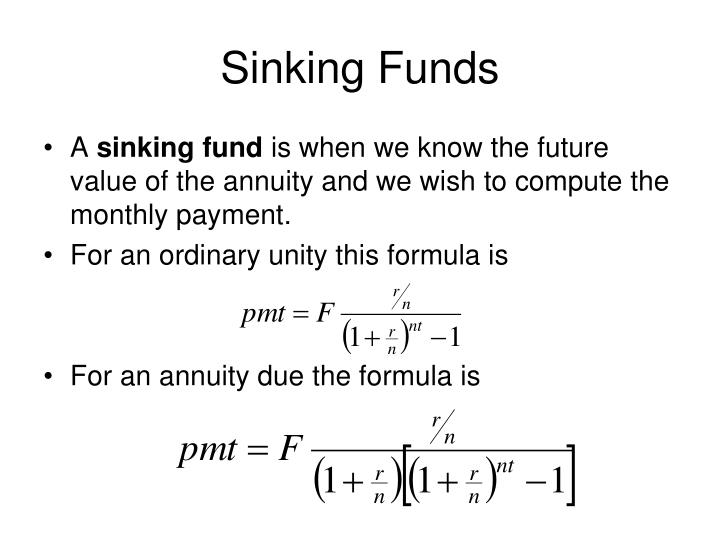

Question description your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. Solved by verified expert:your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. 6d principal quarterly questions railway rate of interest reference revised edition rule second edition shares shillings showing sinking fund solicitor sterling stock exchange system table when annuity tables of exchange take telegraph. A mortgage is a larger loan specifically reserved for the purchase of a home. Sinking funds (find periodic payments) calculate the payment made at the end of each period. Sinking funds • a sinking fund is an account into which periodic deposits are made.

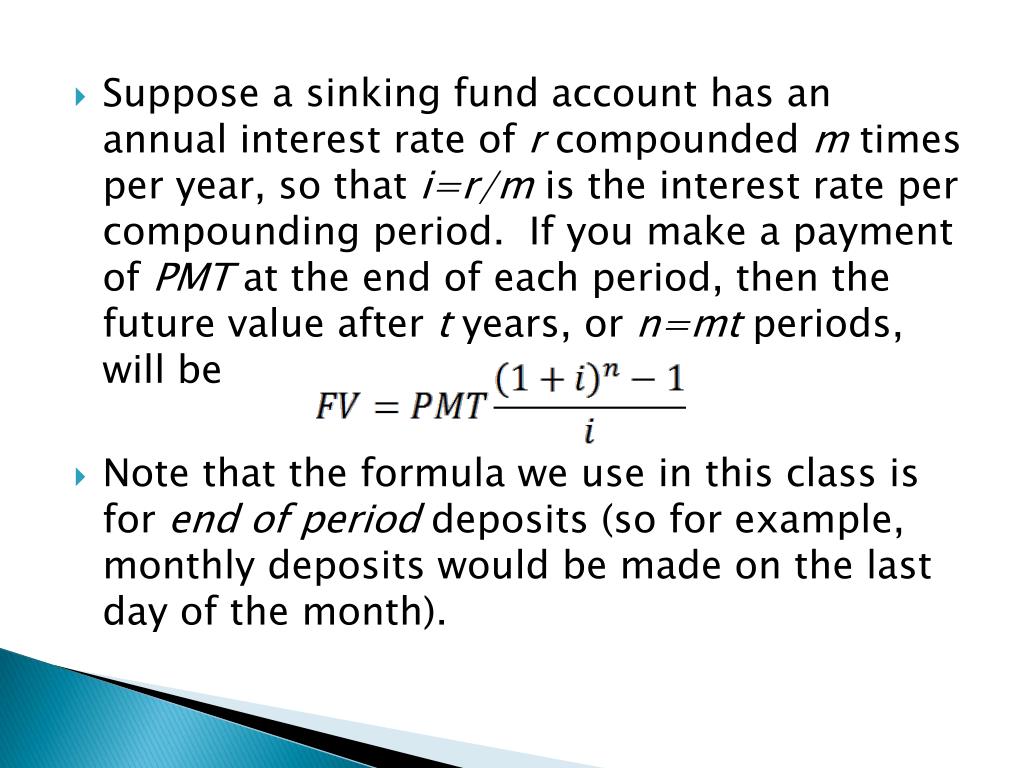

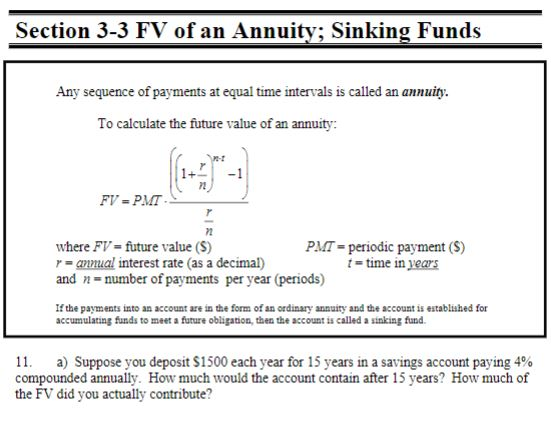

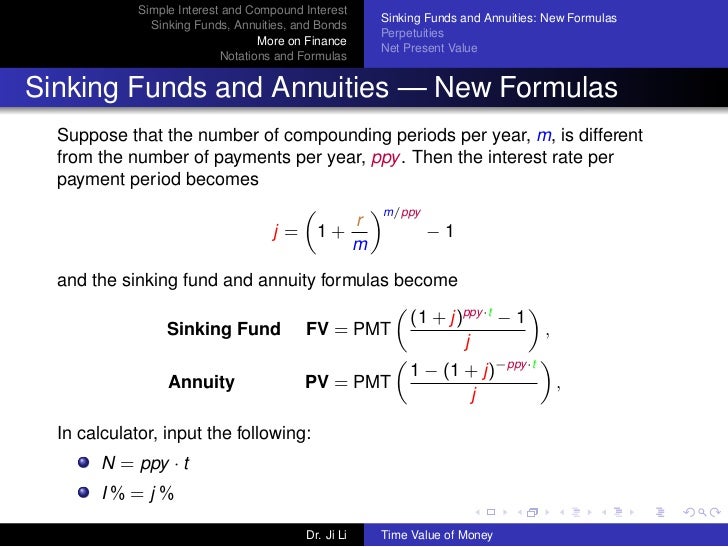

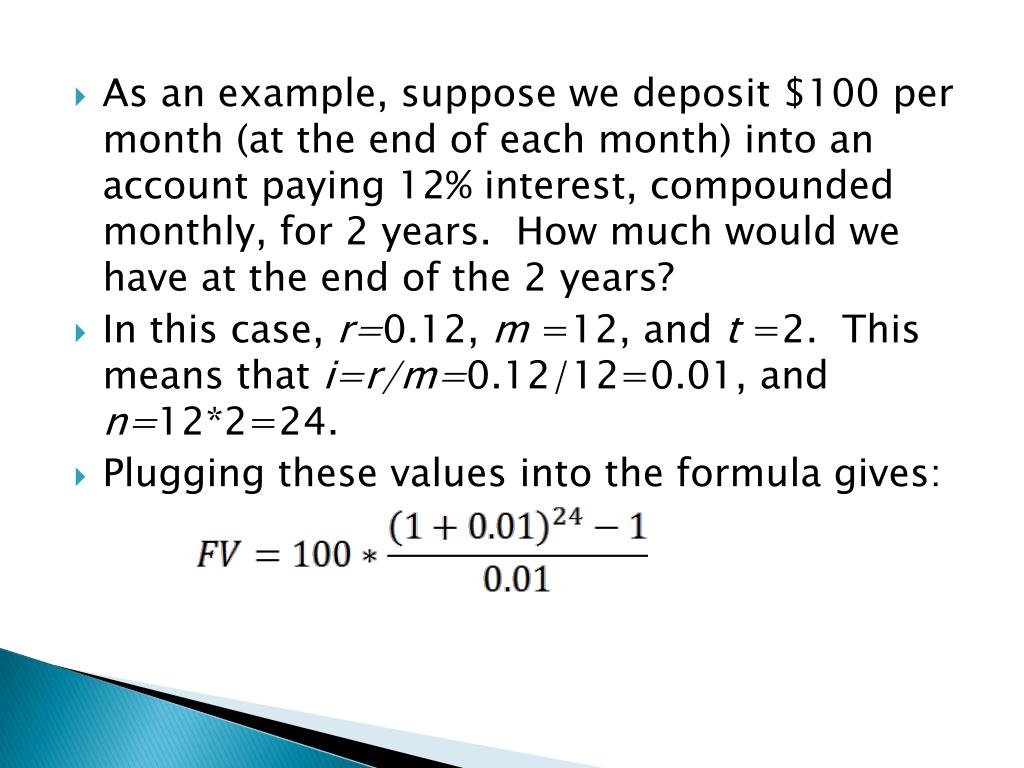

Suppose that the account has an annual interest rate of compounded times per year, so that is the interest rate per compounding period.

The annuity formula and sinking fund formula will make the facts more clear. (vi) under sinking fund method, annual net effect on profit and loss account is same because of uniform fixed amount of depreciation. Solved by verified expert:your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. In annuity method, interest is only assumed as against actual receipt. Effect on p&l is same. Purchasing a home is an important and often intimidating decision.

Source: slideserve.com

Source: slideserve.com

Solved by verified expert:your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. As the first investment is made only at the end of the first year, the first interest is earned only in the second year. (vi) under sinking fund method, annual net effect on profit and loss account is same because of uniform fixed amount of depreciation. As you establish a process to achieve your company goals, you will need to demonstrate your math skills, […] Annuities and sinking funds 1 annuities and sinking funds.

Source: youtube.com

Source: youtube.com

As you establish a process to achieve your company goals, you will need to demonstrate your. Fv (annuity due) the amount is invested at Effect on p&l is same. Suppose that the account has an annual interest rate of compounded times per year, so that is the interest rate per compounding period. A sinking fund is an account earning compound interest into which you make periodic deposits.

Source: youtube.com

Source: youtube.com

Find the future value of an annuity. Ordinary annuity a fixed (or escalating ) investment usually every month for a certain fixed period often until the age of 65yrs, fv future value ; In this section, you will learn to: Question description your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. Quiz 13 annuities and sinking funds.

Source: slideserve.com

Source: slideserve.com

Annuities and sinking funds 1 annuities and sinking funds. A loan is money borrowed that is to be repaid along with interest. The annuity formula and sinking fund formula will make the facts more clear. Annuities and sinking funds sinking fund. As you establish a process to achieve your company goals, you will need to demonstrate your math skills, […]

Source: walmart.com

Source: walmart.com

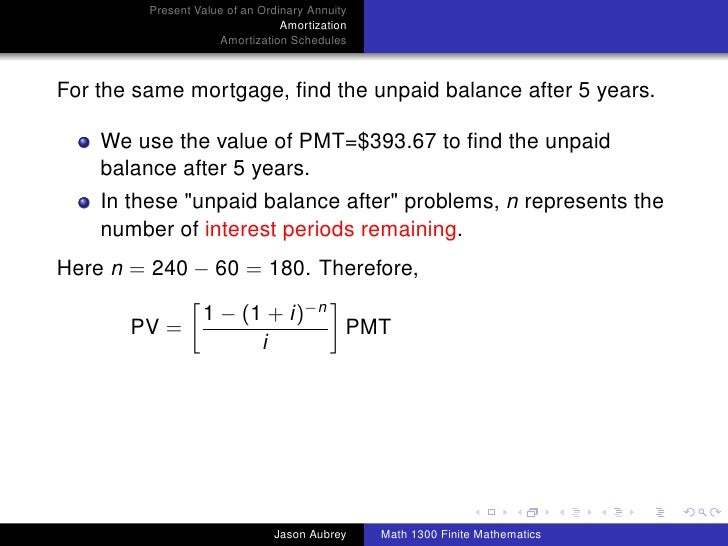

A mortgage is a larger loan specifically reserved for the purchase of a home. The owner of the account sets aside a certain amount of money regularly and uses it only for a specific purpose. 9.4 annuities and sinking funds. In annuity method, interest is only assumed as against actual receipt. Purchasing a home is an important and often intimidating decision.

Source: slideserve.com

Source: slideserve.com

When the fund credit happens for a specific reason, then it is called a sinking fund. Find the future value of an annuity. If you make a payment of at the end of each period, then the future value. However, in annuity method, annual net effect on profit and loss account increases due to fixed depreciation charge and declining interest. As you establish a process to achieve your company goals, you will need to demonstrate your math skills, […]

Source: slideserve.com

Source: slideserve.com

Annuity is an investment that offers payments for a certain period of time as a result of a substantial sum paid up front. (vi) under sinking fund method, annual net effect on profit and loss account is same because of uniform fixed amount of depreciation. A mortgage is a larger loan specifically reserved for the purchase of a home. Investing in a sinking fund is similar to keeping aside a sum of money over a period of time to fund a capital expense in the future. In annuity method interest is only assumed as against actual receipt.

Source: youtube.com

Source: youtube.com

Fund will be available for replacement of the asset. A sinking fund is a type of fund that is created and set up purposely for repaying debt. As the first investment is made only at the end of the first year, the first interest is earned only in the second year. An annuity is one lump sum payment. Annuities and sinking funds 1 annuities and sinking funds.

Source: slideserve.com

Source: slideserve.com

A loan is money borrowed that is to be repaid along with interest. In annuity method, interest is only assumed as against actual receipt. Consider the difference between a sinking fund and an annuity. 9.4 annuities and sinking funds. Sinking funds (find periodic payments) calculate the payment made at the end of each period.

Source: youtube.com

Source: youtube.com

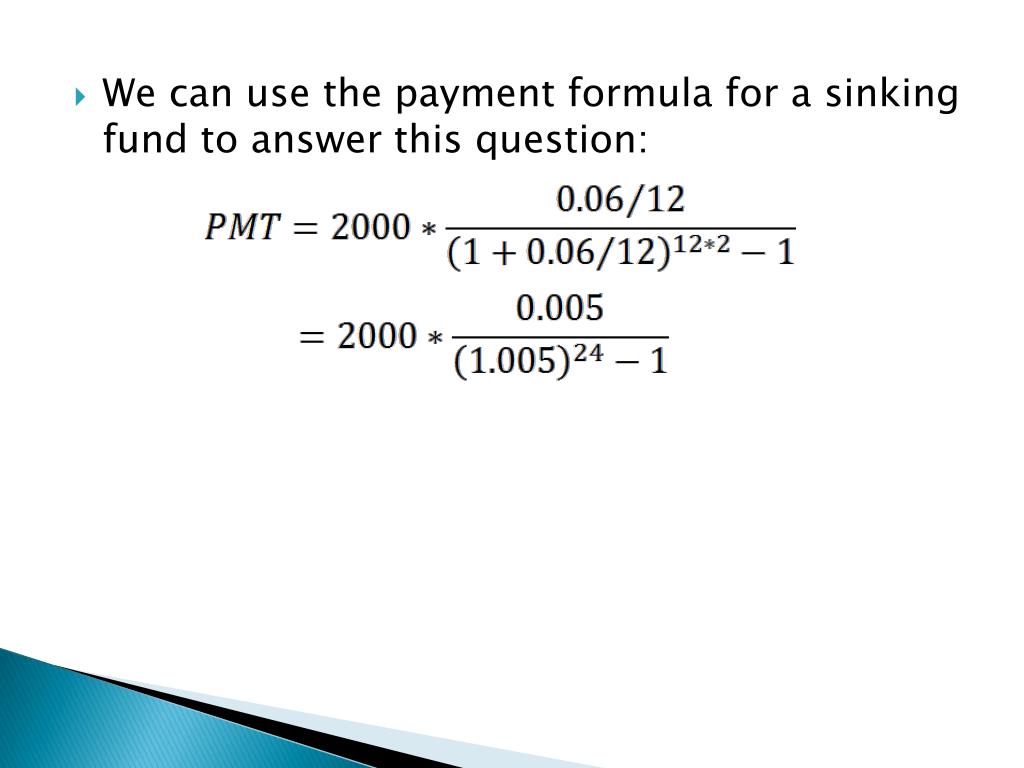

Sinking funds • a sinking fund is an account into which periodic deposits are made. L to derive the sinking fund payment formula we use algebraic techniques to rewrite the formula for the future value of an annuity and solve. Fund will be available for replacement of the asset. A sinking fund is an account earning compound interest into which you make periodic deposits. When the fund credit happens for a specific reason, then it is called a sinking fund.

Source: slideserve.com

Source: slideserve.com

Suppose that the account has an annual interest rate of compounded times per year, so that is the interest rate per compounding period. L to derive the sinking fund payment formula we use algebraic techniques to rewrite the formula for the future value of an annuity and solve. The owner of the account sets aside a certain amount of money regularly and uses it only for a specific purpose. When the fund credit happens for a specific reason, then it is called a sinking fund. Amount generated through depreciation is not invested in market securities.

Source: chegg.com

Source: chegg.com

As you establish a process to achieve your company goals, you will need to demonstrate your math skills, […] Fv ( ordinary) the amount is invested at the end of each month. Sinking fund table is used to calculate depreciation. However, in annuity method, annual net effect on profit and loss account increases due to fixed depreciation charge and declining interest. Simple and compound interest tables, together with notes.

Source: slideshare.net

Source: slideshare.net

Annuity is an investment that offers payments for a certain period of time as a result of a substantial sum paid up front. Annuity is an investment that offers payments for a certain period of time as a result of a substantial sum paid up front. When the fund credit happens for a specific reason, then it is called a sinking fund. • usually, the deposits are made either monthly or quarterly, although the formula allows for any number of deposits, so long as they are regular. In annuity method interest is only assumed as against actual receipt.

Source: youtube.com

Source: youtube.com

As annually, amount is invested in outside securities; Annuities and sinking funds sinking fund. A sinking fund is an account earning compound interest into which you make periodic deposits. Ordinary annuity a fixed (or escalating ) investment usually every month for a certain fixed period often until the age of 65yrs, fv future value ; Instead, it will say something like at the end of each period or at the beginning of each period. you will need to know those mean ordinary annuity and annuity due, respectively.

Source: youtube.com

Source: youtube.com

As you establish a process to achieve your company goals, you will need to demonstrate your math skills, […] L to derive the sinking fund payment formula we use algebraic techniques to rewrite the formula for the future value of an annuity and solve. Investing in a sinking fund is similar to keeping aside a sum of money over a period of time to fund a capital expense in the future. 9.4 annuities and sinking funds. As the first investment is made only at the end of the first year, the first interest is earned only in the second year.

Source: youtube.com

Source: youtube.com

Solved by verified expert:your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. Annuities and sinking funds sinking fund. An annuity is one lump sum payment. Sinking funds • a sinking fund is an account into which periodic deposits are made. Sinking funds • a sinking fund is an account into which periodic deposits are made.

Source: slideshare.net

Source: slideshare.net

Question description your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. A mortgage is a larger loan specifically reserved for the purchase of a home. Annual depreciation is set aside to a separate fund known as depreciation fund. Quiz 13 annuities and sinking funds. (vi) under sinking fund method, annual net effect on profit and loss account is same because of uniform fixed amount of depreciation.

Source: slideserve.com

Source: slideserve.com

Solved by verified expert:your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. The owner of the account sets aside a certain amount of money regularly and uses it only for a specific purpose. Annuities and sinking funds 1 annuities and sinking funds. Solved by verified expert:your assignment is to write an essay discussing how you, as a business owner, can use annuities to achieve business goals. Fv (annuity due) the amount is invested at

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title annuity and sinking funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.