Concentration of credit risk

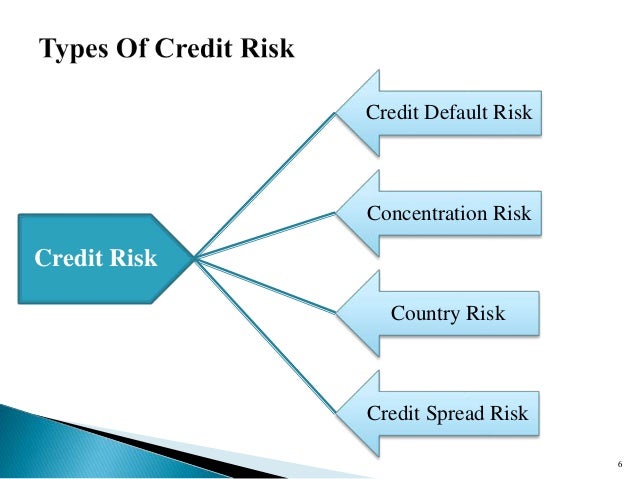

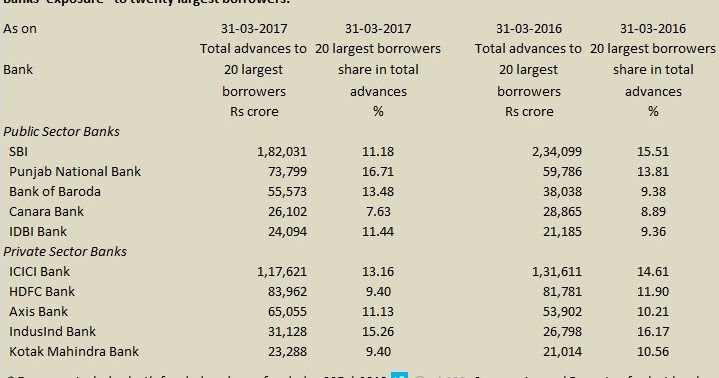

Concentration Of Credit Risk. A correlation is a different concept, since it applies to all borrowers whatever the size of their debt obligations. Each product or service carries some risk of financial exposure or loss for the credit union. Financial institutions face different types of credit risks—default risk, concentration risk, country risk, downgrade risk, and institutional risk. It is therefore important to measure concentration risk in credit portfolios of banks that arises from two sources, systematic and idiosyncratic.

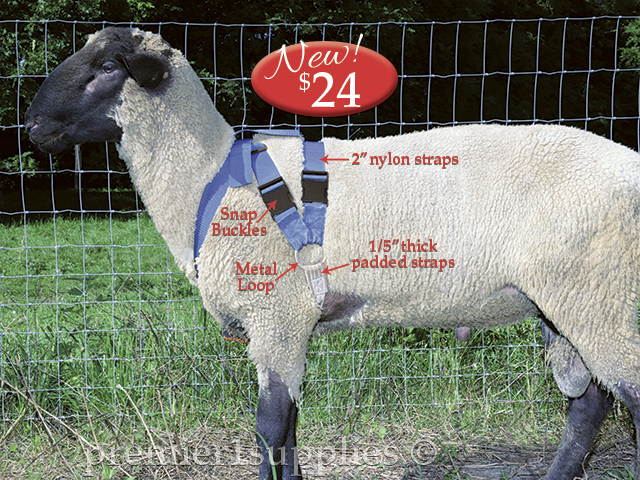

Warning sounded on credit fund concentration risks Fund Managers From asianinvestor.net

While this example provides generic language for this required disclosure, reporting entities will often tailor this disclosure to list specific accounting policies that are subject to estimates (e.g., pension and benefit plans, valuation of goodwill and intangible assets, and allowance for credit losses. Concentration risk, also known as industry risk, is the risk arising from gaining too much exposure to any one industry or sector. Each product or service carries some risk of financial exposure or loss for the credit union. Extensive example credit risk disclosures insurance industry. Concentration risk is defined as the potential loss which we may suffer during the default management process, due to an insufficient diversification with respect to the counterparty. Credit risk is the risk of financial loss to the group if a counterparty to a reinsurance contract or financial instrument fails to meet its contractual obligations, and arises principally from the group’s reinsurance contract assets and investments in debt securities.

For many years, credit markets have been notoriously exposed to issuer concentration risk.

Loss correlation is similar to concentration risk. Credit concentration risk occurs when loans are susceptible to a specific sector of the economy or business group that has slowed down,. Extensive example credit risk disclosures insurance industry. Loss correlation is similar to concentration risk. Monitor credit concentration risk in its credit portfolio. For most banks, loans are the largest and most obvious source of credit risk.

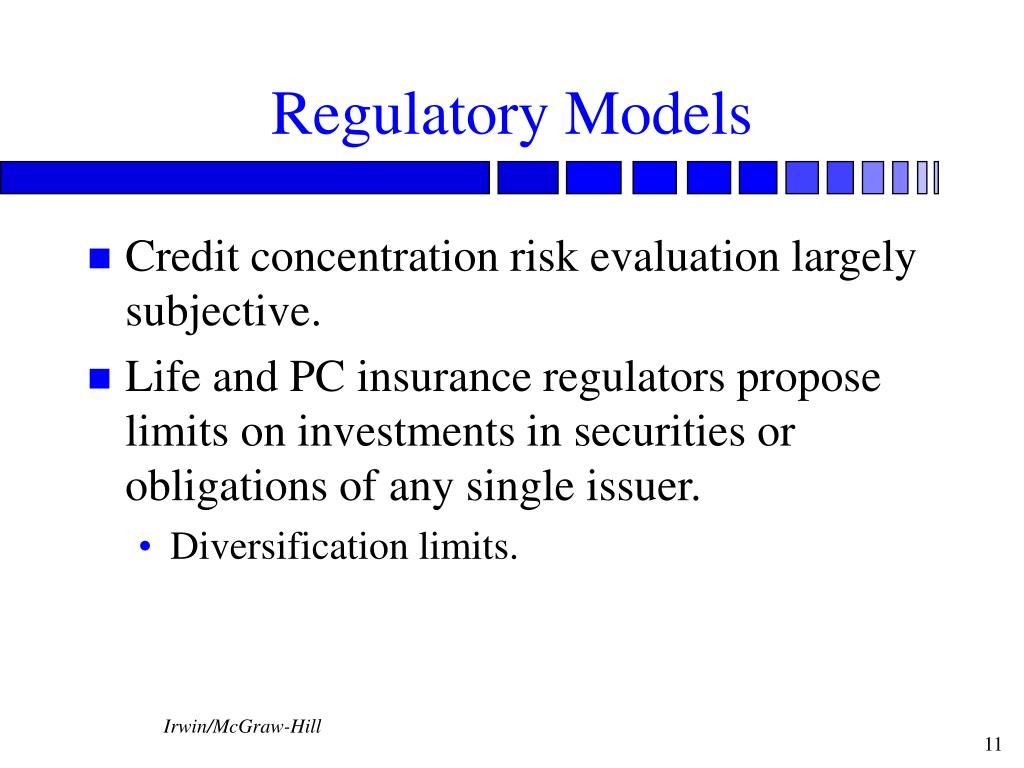

Source: slideserve.com

Source: slideserve.com

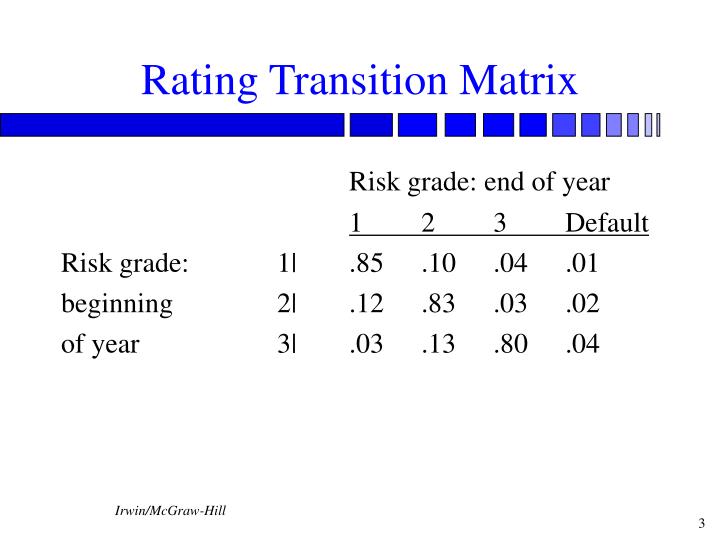

Supervisors plan to incorporate concepts from the basel committee’s large exposures framework into the assessment of credit risk concentration. Among supervisors that set pillar ii capital. In essence, any concentration of sales increases credit risk. Concentration designates the fact that large amounts lent to a small number of borrowers of good credit standing results in very large losses, although with a low probability. Each product or service carries some risk of financial exposure or loss for the credit union.

Source: slideserve.com

Source: slideserve.com

A financial institution shall at least once a year conduct stress tests of its major credit risk concentrations and review the results of those tests to identify and respond to potential changes in market conditions that could inversely impact the financial For many years, credit markets have been notoriously exposed to issuer concentration risk. Managing concentration risk in receivables. Total amount of a concentration exceeds 50% of total capital and the average dollar weighted risk rating of the concentration exceeds 5.0 (less than acceptable) at quarter end. Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation.

Source: eurexclearing.com

Source: eurexclearing.com

Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. The credit manager must identify sources of risk and balance potential sales with potential losses when setting credit policy. Loss correlation is similar to concentration risk. Among supervisors that set pillar ii capital. This disclosure applies to significant credit risk from an individual counterparty or groups of counterparties if those counterparties are engaged in similar activities and have similar economic characteristics (referred to as “group concentrations”).

Source: eurexclearing.com

Source: eurexclearing.com

A correlation is a different concept, since it applies to all borrowers whatever the size of their debt obligations. This booklet applies to the occ�s supervision of national banks and federal savings associations. Each product or service carries some risk of financial exposure or loss for the credit union. Extensive example credit risk disclosures insurance industry. Refer to 12 usc 3102 (b) and the federal branches and agencies supervision booklet of the comptroller�s handbook.

Source: asianinvestor.net

For many years, credit markets have been notoriously exposed to issuer concentration risk. References to national banks in this booklet also generally apply to federal branches and agencies of foreign banking organizations. This booklet applies to the occ�s supervision of national banks and federal savings associations. Credit risk is defined as the potential loss one party may suffer if the counterparty fails to fulfil the contractual obligations arising from its transactions. Concentration risk, also known as industry risk, is the risk arising from gaining too much exposure to any one industry or sector.

Source: eurexclearing.com

Source: eurexclearing.com

A company that is contemplating the extension of credit to a customer can reduce its credit risk most. For many years, credit markets have been notoriously exposed to issuer concentration risk. Your concentration risk policy should require business units engaged in credit transactions to perform a risk assessment to. Senior lending officer is required to prepare a plan to improve quality or reduce concentration to acceptable. The credit manager must identify sources of risk and balance potential sales with potential losses when setting credit policy.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

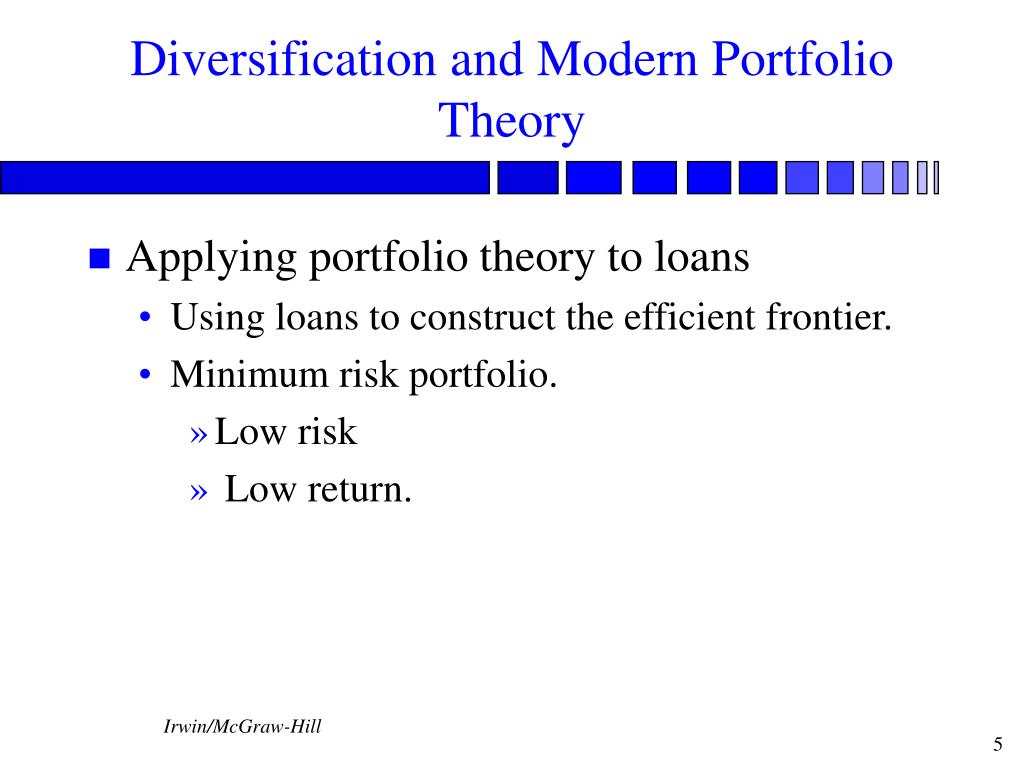

It is therefore important to measure concentration risk in credit portfolios of banks that arises from two sources, systematic and idiosyncratic. Concentration risk is a general term denoting a condition where excess concentration of a value or attribute of a system is the cause of risk. A correlation is a different concept, since it applies to all borrowers whatever the size of their debt obligations. Refer to 12 usc 3102 (b) and the federal branches and agencies supervision booklet of the comptroller�s handbook. It is therefore important to measure concentration risk in credit portfolios of banks that arises from two sources, systematic and idiosyncratic.

Source: slideteam.net

Source: slideteam.net

Credit risk is the uncertainty faced by a lender. Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. This disclosure applies to significant credit risk from an individual counterparty or groups of counterparties if those counterparties are engaged in similar activities and have similar economic characteristics (referred to as “group concentrations”). For example, an investor who lent money to battery manufacturers, tire manufacturers, and oil companies is extremely vulnerable to shocks affecting the automobile sector. The management of accounts receivable can be a complicated task, with direct implications for the firm’s bottom line.

Source: collateralanalytics.com

Source: collateralanalytics.com

Concentration risk, also known as industry risk, is the risk arising from gaining too much exposure to any one industry or sector. For example, an investor who lent money to battery manufacturers, tire manufacturers, and oil companies is extremely vulnerable to shocks affecting the automobile sector. For many years, credit markets have been notoriously exposed to issuer concentration risk. Credit risk is defined as the potential loss one party may suffer if the counterparty fails to fulfil the contractual obligations arising from its transactions. Each product or service carries some risk of financial exposure or loss for the credit union.

Credit risk is the uncertainty faced by a lender. Credit concentration risk occurs when loans are susceptible to a specific sector of the economy or business group that has slowed down,. This disclosure applies to significant credit risk from an individual counterparty or groups of counterparties if those counterparties are engaged in similar activities and have similar economic characteristics (referred to as “group concentrations”). Monitor credit concentration risk in its credit portfolio. Credit risk is the risk of financial loss to the group if a counterparty to a reinsurance contract or financial instrument fails to meet its contractual obligations, and arises principally from the group’s reinsurance contract assets and investments in debt securities.

Source: slideserve.com

Source: slideserve.com

This disclosure applies to significant credit risk from an individual counterparty or groups of counterparties if those counterparties are engaged in similar activities and have similar economic characteristics (referred to as “group concentrations”). In these cases, proper risk management calls for the dispersal of sales to a a larger set of customers. There are several ways to mitigate credit risk. Supervisors plan to incorporate concepts from the basel committee’s large exposures framework into the assessment of credit risk concentration. For many years, credit markets have been notoriously exposed to issuer concentration risk.

Source: slideshare.net

Source: slideshare.net

Concentration designates the fact that large amounts lent to a small number of borrowers of good credit standing results in very large losses, although with a low probability. How to mitigate credit risk. It is therefore important to measure concentration risk in credit portfolios of banks that arises from two sources, systematic and idiosyncratic. Total amount of a concentration exceeds 50% of total capital and the average dollar weighted risk rating of the concentration exceeds 5.0 (less than acceptable) at quarter end. Concentration risk, also known as industry risk, is the risk arising from gaining too much exposure to any one industry or sector.

Source: slideserve.com

Source: slideserve.com

The credit manager must identify sources of risk and balance potential sales with potential losses when setting credit policy. Financial institutions face different types of credit risks—default risk, concentration risk, country risk, downgrade risk, and institutional risk. For example, an investor who lent money to battery manufacturers, tire manufacturers, and oil companies is extremely vulnerable to shocks affecting the automobile sector. Extensive example credit risk disclosures insurance industry. Total amount of a concentration exceeds 50% of total capital and the average dollar weighted risk rating of the concentration exceeds 5.0 (less than acceptable) at quarter end.

Source: slideserve.com

Source: slideserve.com

Extensive example credit risk disclosures insurance industry. Total amount of a concentration exceeds 50% of total capital and the average dollar weighted risk rating of the concentration exceeds 5.0 (less than acceptable) at quarter end. Monitor credit concentration risk in its credit portfolio. Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. In essence, any concentration of sales increases credit risk.

Source: slideserve.com

Source: slideserve.com

Credit concentration risk occurs when loans are susceptible to a specific sector of the economy or business group that has slowed down,. Systematic risk represents the effect of unexpected changes in macroeconomic and financial market conditions on the performance of borrowers. Credit concentration risk occurs when loans are susceptible to a specific sector of the economy or business group that has slowed down,. Credit risk is defined as the potential loss one party may suffer if the counterparty fails to fulfil the contractual obligations arising from its transactions. A company that is contemplating the extension of credit to a customer can reduce its credit risk most.

Source: weltbild.ch

Source: weltbild.ch

Borrowers might not abide by the contractual terms and conditions. Concentration risk, also known as industry risk, is the risk arising from gaining too much exposure to any one industry or sector. The credit manager must identify sources of risk and balance potential sales with potential losses when setting credit policy. For many years, credit markets have been notoriously exposed to issuer concentration risk. Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation.

Source: ramakrishnavadlamudi.blogspot.com

Source: ramakrishnavadlamudi.blogspot.com

Concentration risk, also known as industry risk, is the risk arising from gaining too much exposure to any one industry or sector. In these cases, proper risk management calls for the dispersal of sales to a a larger set of customers. However, there are other sources of credit risk both on and off the balance sheet. This booklet applies to the occ�s supervision of national banks and federal savings associations. The management of accounts receivable can be a complicated task, with direct implications for the firm’s bottom line.

Source: slideserve.com

Source: slideserve.com

In these cases, proper risk management calls for the dispersal of sales to a a larger set of customers. In essence, any concentration of sales increases credit risk. Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. Here are a few simple steps to build a risk management policy for credit unions. A financial institution shall at least once a year conduct stress tests of its major credit risk concentrations and review the results of those tests to identify and respond to potential changes in market conditions that could inversely impact the financial

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title concentration of credit risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.