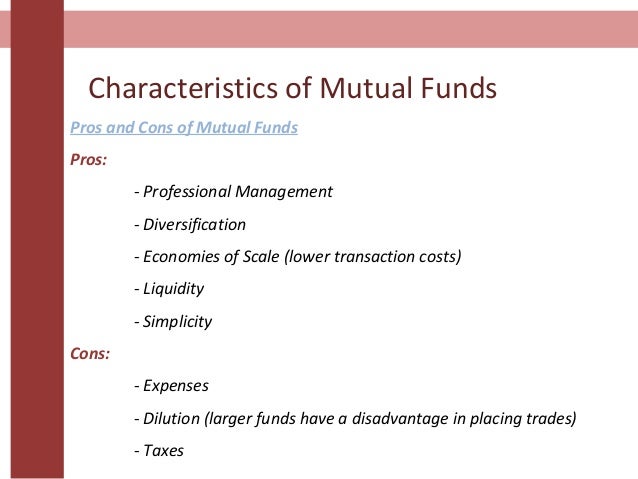

Mutual funds pros and cons

Mutual Funds Pros And Cons. Another benefit of mutual funds is the ability to buy fractional shares. Mutual funds are one of the most popular investment choices in the u.s. There will always be an element of risk when you are investing money somewhere other than a savings account. For starters, you eliminate the need to pick individual securities for an investment portfolio.

Funding Vs Bootstrapping Which is better for your company? TheCodeWork From thecodework.com

Funding Vs Bootstrapping Which is better for your company? TheCodeWork From thecodework.com

Passively managed etfs and index. The right one for you will depend on your goals, risk profile and investment strategy. A unique advantage of mutual funds is that they offer tax benefits. A mutual fund, on the other hand, combines many different assets—including individual stocks—into one grouping. Investing in mutual funds has its advantages. Investing in individual equity shares is highly risky.

Instead, the fund directly owns those securities, and the investor just owns shares of the fund.

Balanced mutual funds hold a mixture of stocks and bonds. This problem occurs because the securities in the fund are not owned directly by the investor. Buying stocks means buying an ownership share of a single corporation, representing a very specific asset. Advantages and disadvantages of mutual funds. Another benefit of mutual funds is the ability to buy fractional shares. Invest a small amount of money.

Source: pinterest.com

Source: pinterest.com

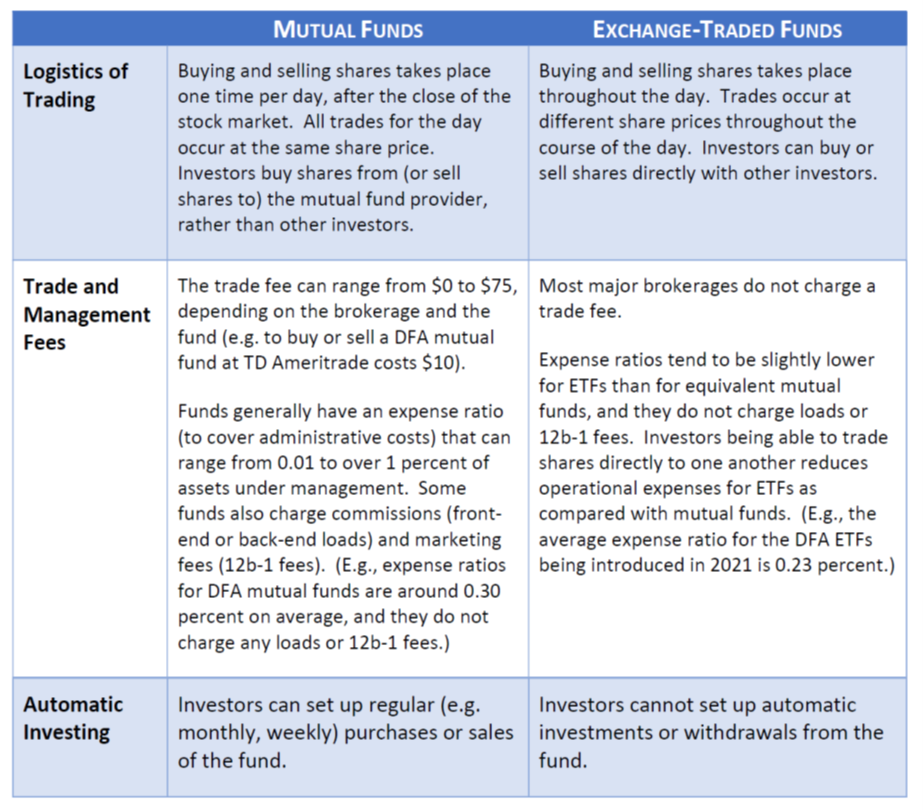

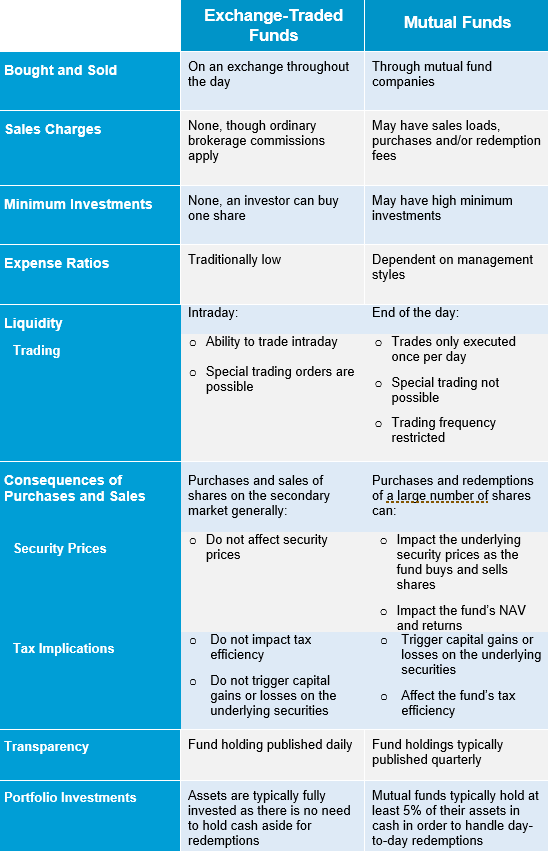

The trading of mutual funds can be a simple. The trading of mutual funds can be a simple. Another benefit of mutual funds is the ability to buy fractional shares. Passively managed etfs and index. Buying stocks means buying an ownership share of a single corporation, representing a very specific asset.

Source: slideshare.net

Source: slideshare.net

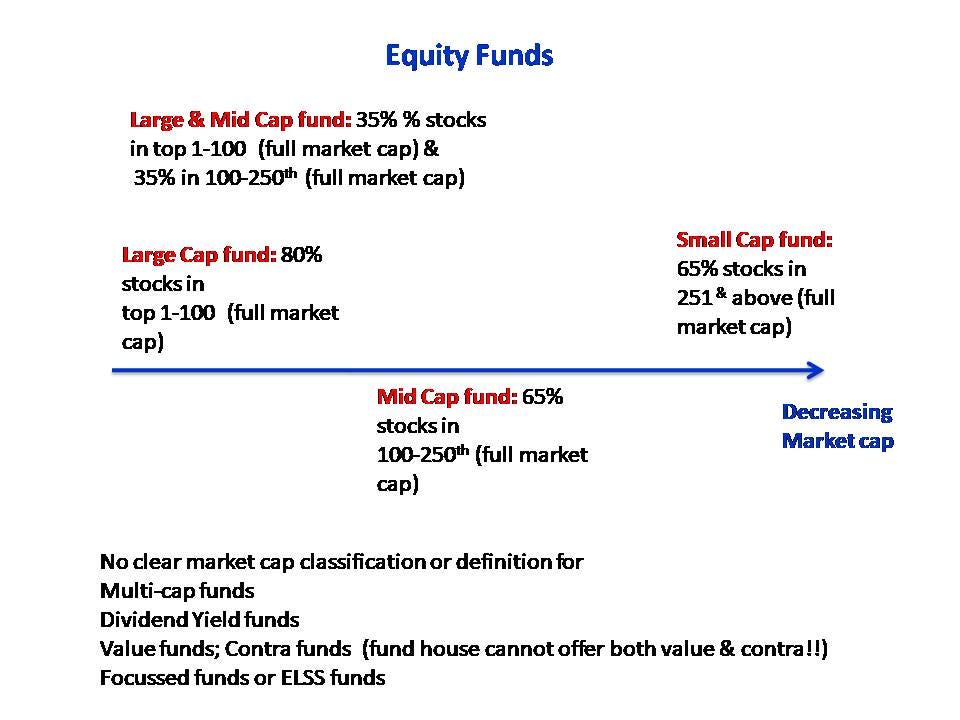

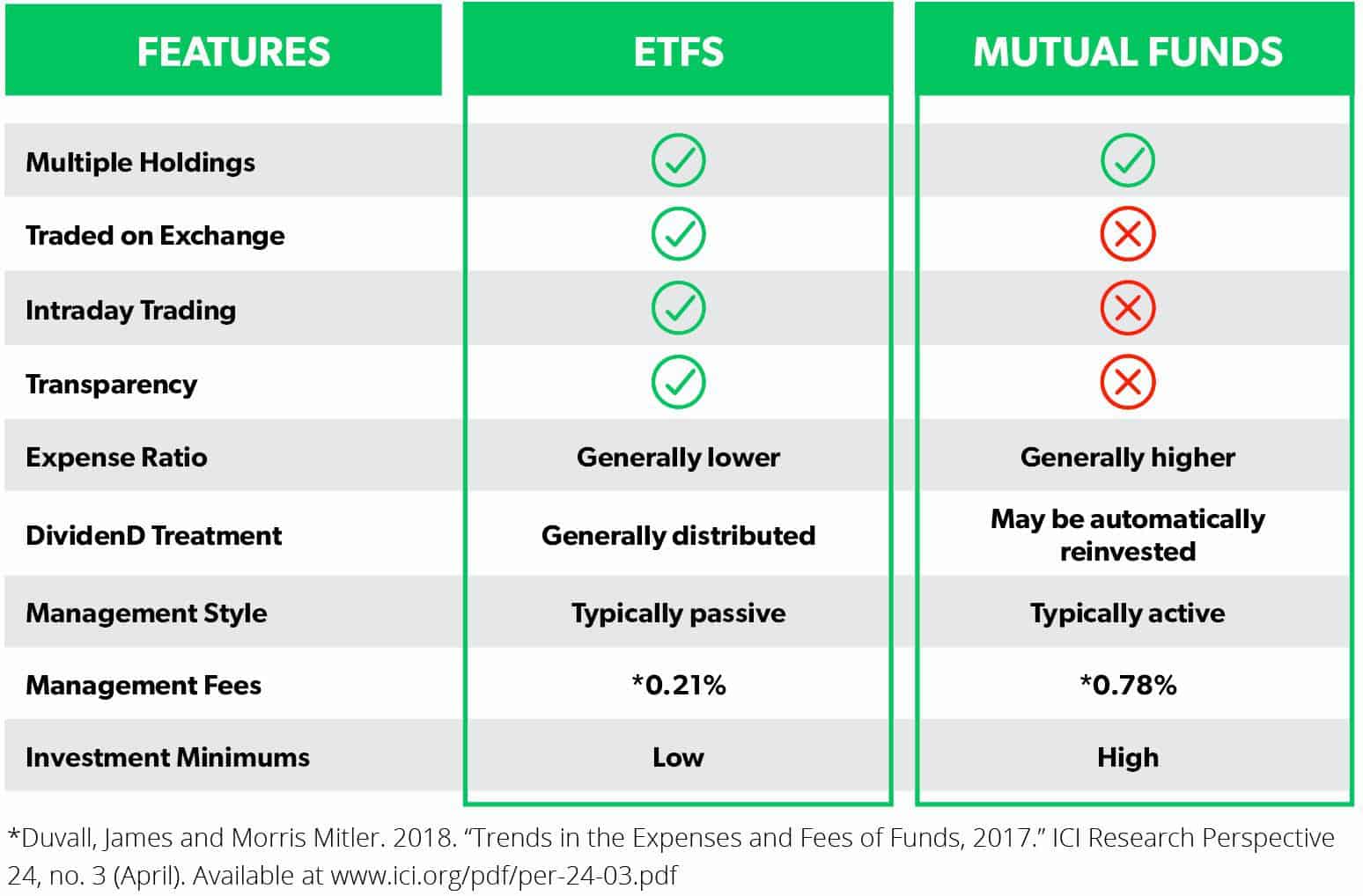

Etfs often have lower fees and expenses: Diversification adds to the primary advantages of investing in mutual funds by investing in different industrial sectors. Ongoing annual fees, primarily going to the fund manager and trustee (often referred to as the management expense ration or mer) range from 0.5% to 3% of the value of your balance, and exit fees usually range from 0% to 2% of the value of your withdrawal. It is possible to lose money with this option, even when there are funds which have a long history of success. For instance, equity mutual funds invest at least 65% of the wealth in company shares and the rest in other assets.

Source: thecodework.com

Source: thecodework.com

For example, if a mutual fund pays out dividends or capital gains, that money can usually be reinvested without any. Mutual funds are one of the most popular investment choices in the u.s. In 2016, the average expense ratio of index etfs was just 0.23% compared with a 0.82% average. One of the biggest mutual funds advantages is that you are instantly diversified. 6 pros of mutual funds #1.

Source: b4investing.com

Source: b4investing.com

The pros of investing in stock mutual funds. Advantages for investors include advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair. In this article, we’ll explain mutual funds, while covering the pros and cons to help you decide if they’re right for you. There are two types of tax inefficiencies inherent in mutual funds. To find out which works best for you, here is a comparison of mutual funds and stocks.

Source: prosancons.com

Source: prosancons.com

Mutual funds offer a family of schemes, and investors have the option of transferring their holdings from one scheme to the other. This takes at least some initiative and. For starters, you eliminate the need to pick individual securities for an investment portfolio. The biggest difference between mutual funds versus stocks is diversity. Another benefit of mutual funds is profit reinvestment.

Mutual funds have poor trade execution. For example, if a mutual fund pays out dividends or capital gains, that money can usually be reinvested without any. Balanced mutual funds hold a mixture of stocks and bonds. This problem occurs because the securities in the fund are not owned directly by the investor. In 2022, trust income is taxed at four levels:

Source: medium.com

Source: medium.com

Investing in mutual funds has its advantages. Investing in individual equity shares is highly risky. Mutual funds offer a family of schemes, and investors have the option of transferring their holdings from one scheme to the other. Etf expense ratios are typically lower than mutual fund fees. Advantages for investors include advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair.

Source: profinancialsolutions.com

Source: profinancialsolutions.com

The pros of investing in stock mutual funds. In 2022, trust income is taxed at four levels: Advantages and disadvantages of mutual funds. The pros and cons of mutual funds will usually shade toward the advantages for most investors. Another benefit of mutual funds is the ability to buy fractional shares.

Source: freestudy.com

Source: freestudy.com

There are two types of tax inefficiencies inherent in mutual funds. Mutual funds are one of the most popular investment choices in the u.s. To find out which works best for you, here is a comparison of mutual funds and stocks. A mutual fund, on the other hand, combines many different assets—including individual stocks—into one grouping. Because of these expenses and fees, mutual funds are an attractive.

Source: pinterest.com

Source: pinterest.com

Etfs often have lower fees and expenses: Investing in individual equity shares is highly risky. To find out which works best for you, here is a comparison of mutual funds and stocks. A unique advantage of mutual funds is that they offer tax benefits. Mutual funds can suffer from an embedded capital gains problem.

Source: dollarsprout.com

Source: dollarsprout.com

Invest a small amount of money. Mutual funds offer a family of schemes, and investors have the option of transferring their holdings from one scheme to the other. In 2022, trust income is taxed at four levels: This is a common strategy for investors. There will always be an element of risk when you are investing money somewhere other than a savings account.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

For instance, equity mutual funds invest at least 65% of the wealth in company shares and the rest in other assets. Instead, the fund directly owns those securities, and the investor just owns shares of the fund. Advantages for investors include advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair. Professional fund managers essentially do that for you and create a. There are many advantages of investing in fof and the risk profile of an fof is moderate.

Source: mymoneysage.in

Source: mymoneysage.in

The pros and cons of mutual funds will usually shade toward the advantages for most investors. A unique advantage of mutual funds is that they offer tax benefits. Instead, the fund directly owns those securities, and the investor just owns shares of the fund. This problem occurs because the securities in the fund are not owned directly by the investor. In this article, we’ll explain mutual funds, while covering the pros and cons to help you decide if they’re right for you.

Source: pinterest.com

Source: pinterest.com

There will always be an element of risk when you are investing money somewhere other than a savings account. Mutual funds are one of the most popular investment choices in the u.s. This is so because one, an fof invests in units of other mutual funds. The right one for you will depend on your goals, risk profile and investment strategy. Investing in mutual funds has its advantages.

Source: pinterest.com

Source: pinterest.com

Mutual fund investors now enjoy income tax benefits. 6 pros of mutual funds #1. Perhaps the most positive aspect of a stock fund is that you can invest in a single stock fund and have money invested in hundreds of individual stocks. For example, a balanced fund may aim to hold 70% of its portfolio in american stocks and 30% of its portfolio in american bonds. Investing in individual equity shares is highly risky.

Source: bank.caknowledge.com

Source: bank.caknowledge.com

Mutual funds and stocks each offer specific types of advantages to investors. Buying stocks means buying an ownership share of a single corporation, representing a very specific asset. A unique advantage of mutual funds is that they offer tax benefits. Balanced mutual funds hold a mixture of stocks and bonds. Investing in individual equity shares is highly risky.

Source: ultimusfundsolutions.com

Source: ultimusfundsolutions.com

The biggest difference between mutual funds versus stocks is diversity. The pros of investing in stock mutual funds. Etfs often have lower fees and expenses: The biggest difference between mutual funds versus stocks is diversity. Mutual funds offer a family of schemes, and investors have the option of transferring their holdings from one scheme to the other.

Source: prosdecons.com

Source: prosdecons.com

Disadvantages include high fees, tax inefficiency, poor trade execution, and the potential for management abuses. Invest a small amount of money. Disadvantages include high fees, tax inefficiency, poor trade execution, and the potential for management abuses. Another benefit of mutual funds is profit reinvestment. Balanced mutual funds hold a mixture of stocks and bonds.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title mutual funds pros and cons by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.